A4 Double Entry System

Bookkeeping refers to the process of recording the financial transactions of a business. This includes all of the money a business receives as well as any spending. Transactions are recorded under different ‘accounts’ depending on the type of income or expenditure. These may include cash, assets or ICT.

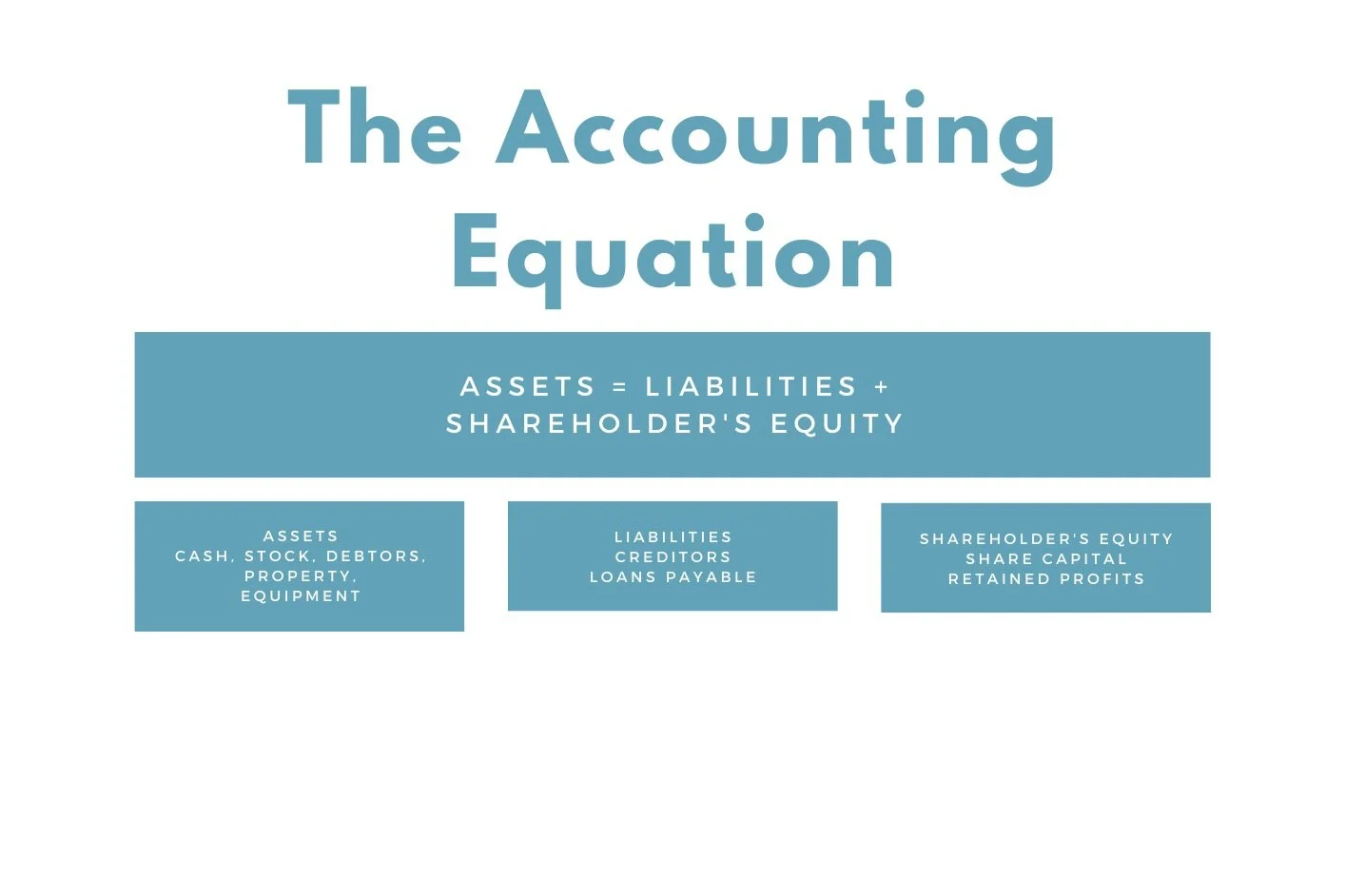

The accounting equation is that assets should be equal to liabilities and shareholder equity (investment). This can be rearranged as assets - liabilities equals shareholder equity.

Double-entry bookkeeping is a method of recording financial transactions where each transaction has to be recorded twice. A general ledger is a document where every transaction for a business is recorded. A T Account is a visual representation of a single account including debits and credits. It is called this because it looks like a T.

Debits refer to items recorded on the left hand side of a ledger. When assets and expense balances increase, they are debited. When liability, equity and revenue balances decrease they are debited.

Credits refer to items recorded on the right hand side of the ledger. When assets and expense balances decrease, they are credited. When liability, equity and revenue balances increase they are credited.

Example

For example, Hungry Hounds, a dog food manufacturer made sales of $2000 of dog food on 2nd January. This sale increased the cash (asset) balance which was therefore debited. The sale also increased the revenue balance which was credited. On 3rd January, they purchased dog food labels for $500. This increased the expense balance which was therefore debited. The purchase decreased the cash (asset) balance that was credited.

As can be seen in this example, every debit transaction must be matched by a credit transaction. If debits and credits do not balance, there has been an error in recording.