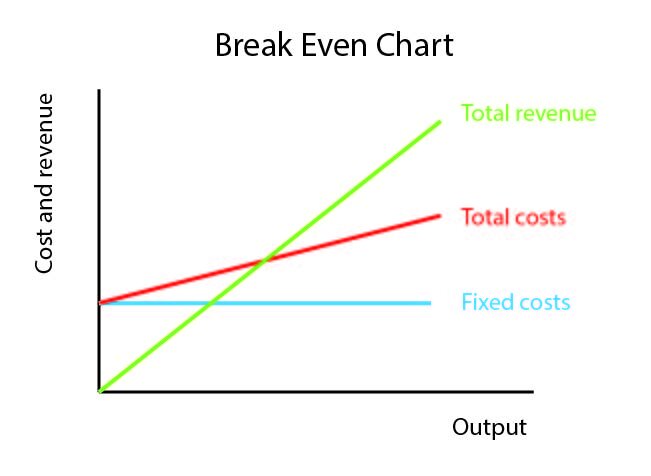

F3 Break-Even Charts

The break Even point is the level of output where costs equal revenue. No profit or loss is being made at this point. If one more unit is produced and sold, profit will be made. If one less unit is made and sold, a loss will be made. It is calculated using the following formula;

BEP = fixed costs / contribution

Or

BEP = fixed costs / (price - variable cost)

Costs and Revenues

Fixed costs are the costs that do not change with output such as rent and other premises costs, salaries and rental of machinery and equipment.

Variable costs are those that do change with output for example raw materials and packaging costs. If a business produced more of a product, they would have to purchase more raw materials and vice versa.

Total variable costs = variable costs x output

Total costs are the sum of the fixed costs and variable costs at each level of output.

Total costs = fixed costs + total variable costs

Semi-variable costs contain elements of both fixed and variable costs. They will usually be fixed up to a point and then become variable. An example of semi-variable costs is a phone bill where there is a set monthly bill up to a point but if the data package is exceeded, it is paid for per unit of data used.

Sales revenue is the money received from selling the products. It is calculated by multiplying the price by output.

Total revenue = price x output

Contribution is the amount of money per unit left after paying variable costs. This can be used to contribute towards fixed costs and profits.

Contribution = price - variable cost

Margin of Safety

The margin of safety (M.O.S.) is the amount of units sales can drop by before a loss is made. It is the difference between the estimated sales and break even point.

M.O.S. = estimated sales - BEP

Break Even Example

Beets Me Burgers have released the following financial data;

Fixed costs of $70,000 per month.

Variable costs of $30.

Selling price of $70.

Calculate the break even point and construct a break even chart for beats me burgers.

Calculate the margin of safety if output was 1300.

Benefits and Limitations of Break Even Analysis

Benefits

Quick and easy calculations

Charts are easy to interpret

Gives a production target

Can be used to estimate resource requirements

Can easily assess whether the production of a product is viable

Limitations

Assumes all products are sold

Assumes all lines are linear

Does not account for multiple products

Static model in a dynamic environment

Ignores factors other than cost and revenue

GIGO