Fiscal Policy - 20 Multiple Choice Questions

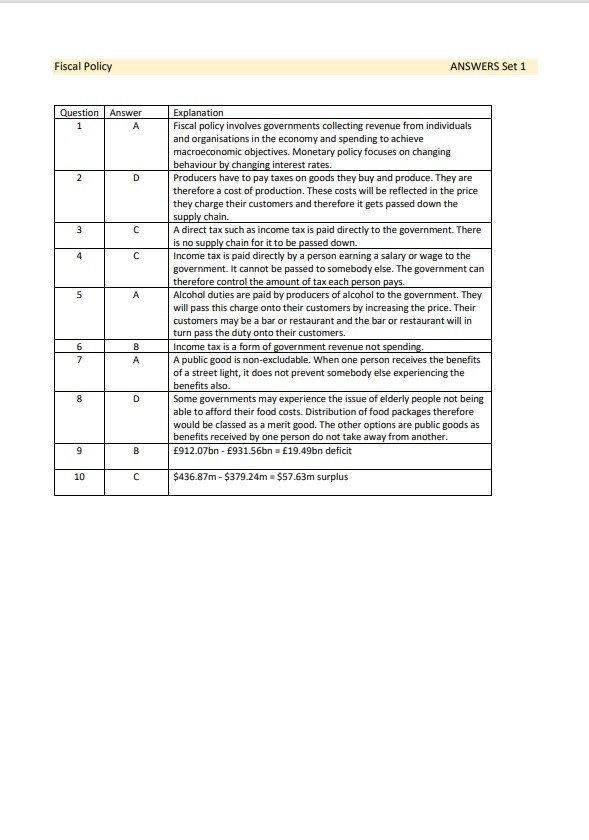

Fiscal policy refers to the taxation and spending of governments to make improvements to the economy.

20 multiple choice questions and fully explained answers about Fiscal Policy. Part of Macroeconomics. Questions include

Taxation

direct and indirect tax

public and merit goods

fiscal surplus and deficit

Expansionary and contractionary fiscal policy

A great AFL resources to quickly check student understanding.

Print out and issue to your class, display on your whiteboard or share electronically via a VLE.

Suitable for

GCSE Economics

GCSE Business Studies

A Level Economics

A Level Business Studies

IB Business Management

Fiscal policy refers to the taxation and spending of governments to make improvements to the economy.

20 multiple choice questions and fully explained answers about Fiscal Policy. Part of Macroeconomics. Questions include

Taxation

direct and indirect tax

public and merit goods

fiscal surplus and deficit

Expansionary and contractionary fiscal policy

A great AFL resources to quickly check student understanding.

Print out and issue to your class, display on your whiteboard or share electronically via a VLE.

Suitable for

GCSE Economics

GCSE Business Studies

A Level Economics

A Level Business Studies

IB Business Management

Fiscal policy refers to the taxation and spending of governments to make improvements to the economy.

20 multiple choice questions and fully explained answers about Fiscal Policy. Part of Macroeconomics. Questions include

Taxation

direct and indirect tax

public and merit goods

fiscal surplus and deficit

Expansionary and contractionary fiscal policy

A great AFL resources to quickly check student understanding.

Print out and issue to your class, display on your whiteboard or share electronically via a VLE.

Suitable for

GCSE Economics

GCSE Business Studies

A Level Economics

A Level Business Studies

IB Business Management